Pet ownership brings immense joy, but unexpected vet bills can quickly become a financial burden. That's where pet insurance comes in, offering peace of mind and financial protection for your beloved companion. However, navigating the world of pet insurance can be daunting. With numerous policies, coverage options, and terminology, it's easy to feel overwhelmed. This comprehensive guide aims to here clarify the complexities of pet insurance, equipping you with the knowledge to make informed decisions and find the perfect plan for your furry friend.

First, let's examine the different types of pet insurance coverage available. Commonly, policies fall into two categories: accident-only and comprehensive. Accident-only coverage pays for expenses incurred due to accidents, such as broken bones or injuries sustained during playtime. Comprehensive plans, on the other hand, provide broader protection by addressing both accidents and illnesses.

Choosing the right coverage depends on your pet's age, breed, health history, and your budget. It's also crucial to comprehend the policy's deductible, reimbursement rate, and waiting periods before coverage begins.

Navigating the Secrets of Pet Health Coverage

Ensuring your furry family member's well-being is paramount, and understanding the intricacies of pet health coverage can be a daunting task. With various policies available, it's crucial to carefully analyze your needs and budget. A comprehensive pet health plan should ideally address routine medical care, emergency expenses, and potential chronic conditions. Researching different providers and their coverage can help you make an informed decision that safeguards your pet's health for years to come.

- Discuss your veterinarian about the best coverage options for your pet's specific needs.

- Thoroughly read the policy documents to understand the limitations

- Contrast quotes from different providers to find the most affordable plan.

Should You Get Pet Insurance? A Guide to the Essentials

Bringing a furry friend into your life is a fantastic experience. However, unexpected veterinary expenses can quickly strain even the tightest budgets. That's where pet insurance comes in. This comprehensive guide will help you discover if pet insurance is the right decision for your family and your beloved animal.

To launch our exploration, let's review the basics of pet insurance.

- First, we'll delve into the different types of pet insurance offered.

- Next, we'll consider coverage options, including accidents, illnesses, and even alternative therapies.

- Lastly, we'll tackle factors to think about when picking a pet insurance plan.

Choosing the Best Pet Insurance Plan

Navigating the world of pet insurance can feel overwhelming, but it doesn't have to be. To help select a plan that truly covers your furry friend's needs and your budget. Start by evaluating your pet's breed, age, and health history. Some breeds are prone to certain ailments, so factor this into your selection. Next, figure out what type of coverage you need, such as accident-only or comprehensive plans. Also compare quotes from different insurers and look closely at the out-of-pocket costs. Don't hesitate to seek clarification on anything you don't understand.

- Remember that pet insurance is an investment worth making for your beloved companion.

- By putting in the effort to choose the right plan, you can provide your pet with the best possible care.

Submitting Pet Insurance Claims: A Step-by-Step Guide

Navigating the world of pet insurance can sometimes feel overwhelming, especially when it comes to filing claims. However, understanding the process and following these simple steps can make it a seamless experience. First, scrutinize your policy documents carefully to identify the specific requirements for your pet's coverage. Next, when an incident occurs, immediately contact your insurance provider to report the event and obtain a claim number.

- Gather all necessary documentation, including veterinary receipts, treatment records, and any other relevant information.

- Complete the claim form accurately and thoroughly, providing all required detail.

- Attach the supporting documentation to your claim form sturdy.

- Send your completed claim package to the address specified by your insurance provider.

Once your claim is received, the insurer will review it and inform you of their decision. Should you have any questions or concerns throughout the process, don't hesitate to speak with your insurance provider's customer service team.

Exploring the World of Pet Insurance Pricing and Benefits

Bringing a furry friend into your life is a joyous occasion, but it also comes with financial responsibilities. Unexpected vet bills can put a strain on even the most well-prepared pet parents. That's where pet insurance steps in to provide peace of mind and help you navigate those unexpected costs.

Before you dive into the world of plan comparisons, it's essential to understand the factors that influence pet insurance costs. These include your pet's breed, age, location, and the level of protection you choose.

- Animal health policies

- Veterinary expenses

To get the best deal for your funds, it's crucial to carefully evaluate different pet insurance providers. Don't hesitate to inquire about details and ensure you fully understand the terms and conditions before making a choice.

Ralph Macchio Then & Now!

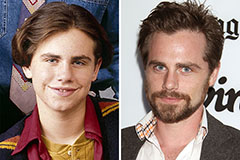

Ralph Macchio Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!